By Marilia Assis

Home to HQ’s, market infrastructure & governmental support

The state is home to the headquarters of major financial institutions of the Country and to BM&FBOVESPA S.A. – Stock, Commodities and Futures Exchange, one of the largest exchanges in the world by market value. Brazilian banks, as Bradesco and Itaú, are already adapting to the reality of the fintech potential, creating incubators and partnerships with new startups. São Paulo hosts the best fintech oriented incubator (Cubo) and accelerator programs of the country (InnovaBra, Oxygenio, Wayra , Startup Farm, and Track). Besides the support of the financial institutions, the Sao Paulo government also offers free consultancy and assistance for fintech entrepreneurs and investors.

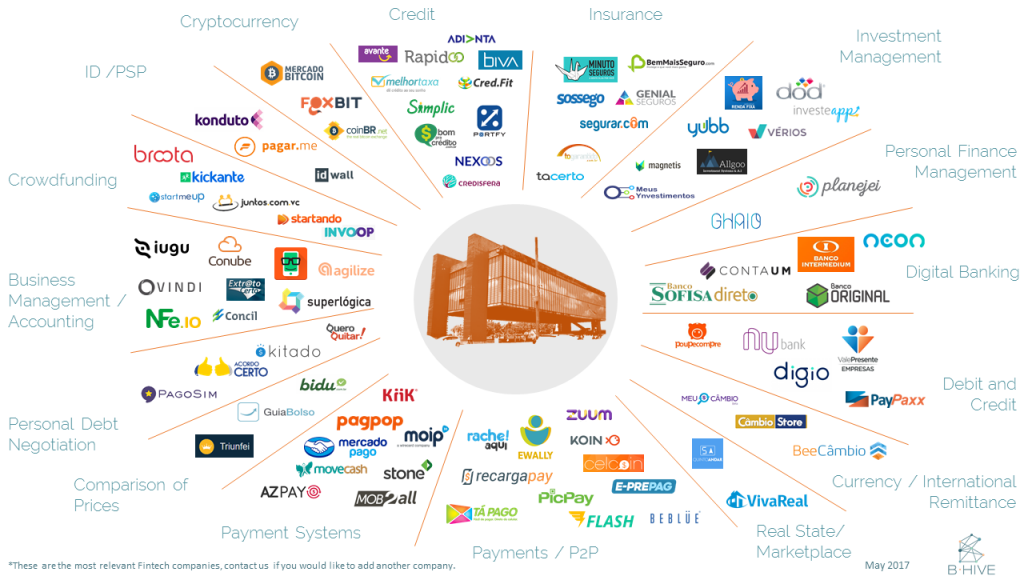

The state eclipse more than 80 fintechs, including Nubank (total equity funding of $178M) and Guia Bolso (total equity funding at $23M). The first, Nubank, is a digital and branchless credit card company, that with thanks to its creative marketing strategy (check out their strategy), has 7 million customers and 500,000 are currently on the waiting list to get their cards. The second, Guia Bolso, is automating the process of personal financial management and is listed by KPMG as one of the emerging fintech startups around the world. Impressive, right?

An ideal sandbox for fintech?

Brazil is still working on the ideal sandbox for fintech. By now the regulations are still high. In an interview for B-Hive, James Goulart, Product Owner at Nexoos (a Brazilian peer-2 peer-lending company), said that for VCs this regulated market is an advantage: Indeed Brazilian startups tend to live longer than startups in the US for instance, where barriers to entry are lower. The risk associated with investing in Brazilian fintechs, therefore, becomes lower and more stimulating for Venture Capital companies. This information is supported by the total fintech VC deal value for São Paulo in 2016: $16M. In correlation to the numbers in Europe: It is more than the Benelux and the Scandinavian countries fintech VC deals together.

As good sailors searching for gold, we should know where the mines are located. São Paulo is becoming a hot spot, giving the location and the market reach. Brazil has more than 50 million people without access to financial services: and they are all potential customers, speaking the same language and under the same regulation. In an interview for B-Hive Caio Davidoff, CEO of Pagcom (payment system), recognised this advantage: If the fintechs can rise to this challenge, the rewards for the financial industry and the broader Brazilian economy could be significant. Meaning: when Brazilian fintechs start to target in financial inclusion, the industry will boom, and this moment is getting closer.

By Marilia Assis via B-Hive

Quer uma dica?

Faça parte do principal encontro da comunidade de inovação e tecnologia em crédito no dia 01 de novembro em São Paulo. Saiba mais clicando aqui ou acessando http://credtech.conexaofintech.com.br/

Aproveite o desconto de 15% para nossos leitores por tempo limitado. Use o código conexaofintech ou clique aqui e garanta sua vaga.